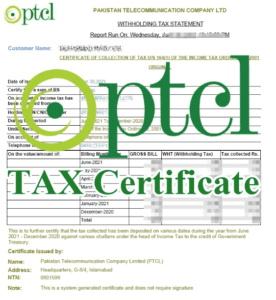

PTCL Withholding Tax Certificate download

What is a PTCL Withholding Tax Certificate?

A PTCL Withholding Tax Certificate, generally known as a retention tax, is an income tax that is paid to the government by the person who earns the money rather than the person who receives it.

As a result, the tax is withheld or deducted from the recipient’s taxable income.

Employment income is subject to withholding tax in most jurisdictions.

How to Get PTCL Withholding Income Tax Certificate?

Most persons are unaware of how smooth it is to obtain their PTCL withholding tax statements online in just a few minutes.

In this post, I’ll teach you how to collect your PTCL and Evo/ CharJi withholding tax certificates online in a step-by-step process.

Use the following website to obtain a tax certificate. You will be taken to the official PTCL website, where you will be asked to choose a service. Information such as account id and tax period will be requested, according to the provider.

PTCL offers both certificates for its landline and EVO/CharJi. You can download each one and submit it to FBR.

Steps to Get PTCL Withholding Tax Certificate

- Get the PTCL withholding certificate by using the following link.

- You will be redirected to the relevant page on the ptcl website.

- Select service type; Landline or Evo/ CharJi

- Select the area code and enter your phone number.

- Write your Account ID (available on your bill).

- Select period for withholding tax statement is required.

- Write the alphabet as shown in the captcha image.

- Click on “Inquire Tax” and your tax certificate will be shown to you. You can save it in the form of pdf by clicking the right mouse button.

How to Get Income Tax Deduction for EVO/Charji

Getting the withholding income tax certificate for EVO or charji devices is almost similar to what we explain for a landline. However, the procedure bit changed you require additional information to put in while filling out the form online.

Follow the given steps below and get your tax document easily:

- Visit the official PTCL landline website here.

- Select service type ” EVO/Cahrji “

- Put your device MDN number without +92.

- Now enter ESN No/ICCID (This number is available on your device)

- After that NTN/CNIC number of the device owner.

- Choose month and year period for withholding tax statement.

- Enter the words provided in the captcha.

- Finally, click on the Inquire Tax button.

- That’s it! Your withholding tax certificate will display on your screen.

Why Do You Need a Withholding Tax Certificate?

The fiscal year 2020-2021 has just ended, and people will soon begin completing their income tax returns with the Federal Bureau of Revenue (FBR).

People also require a PTCL withholding Tax Statement or a PTCL withholding Tax Certificate to claim Withholding Tax (WHT).

Some customers call the PTCL helpline for a tax deduction certificate, which takes time because you must check your details with the helpline agent, after which he or she will email you your PTCL WHT Certificate within the next 24 to 48 hours.

Also, Read on Techbeast.

- Change PTCL Wifi Password

- How to search PTCL number with name and address

- Get a Jazz Tax Certificate in 2023

- Ufone Tax Certificate Online 2023