HBL Car Loan Eligibility Criteria – Monthly Markup Plan

Today in this article we will discuss all details about how you can get a car loan through HBL. We will drive you through the whole procedure of the HBL car loan.

We will answer all your questions like how much you have to do the down payment, how much you have to pay on monthly basis, how much is markup plan on every car, the minimum, and maximum markup plan, and how much the loan can you get for a car. Or how much loan other banks are providing.

Today we will discuss all terms and conditions of the HBL car loan. You can select your desired car on a fixed 1.90% insurance rate and a markup rate of 10.99%.

HBL Car Loan Eligibity Criteria

- You can get a loan between 200000 to 5000000 for the car.

- Option to choose between a new car and a used car.

- If you get a new car through HBL then you have to return the loan within 7 years.

- If you apply for a used car loan, you have to return the loan within 5 years.

- Option to select between floating and fixed-rate, this means you can set your loan budget between 200000 to 5000000.

- Insurance and tracker option for the safety of your car and money.

- You can select from over 150 car brands, this means you have more and more brands to select from.

- With more than 1700 branches all over the country, HBL is almost available in every city. You can easily visit your nearest branch.

- 24/7 customer service.

- Committed after-sale service.

HBL Car Loan Monthly Markup Plan

If you are a new HBL consumer and want to buy a vehicle worth 20,00000 and desiring to repay in about 12 months 15288/- pkr. The monthly markup plan can be changed accordingly.

Note: Calculations are independent of insurance charges. The monthly payment is conditional and ruled to change.

Musharakah Based Islamic Car Finance

With HBL Islamic musharakah based car financing you can easily get your dream car.

HBL Islamic Car Financing Key Features

- According to the musharakah based financing, there is a limit between PKR 200,000 to 10,000,000/-

- For particular use, you can also finance new, used, or imported vehicles.

- For new cars, the payment tenure ranges from 1 to 7 years but for used cars the payment tenure is 5 years.

- Global Takaful adjustment through business associates on HBL panel.

- Inauguration of rentals simply after delivery of the vehicle to the consumer

- Immediate processing with the merest documentation.

- Multiple alternatives are available for partial payment.

- Other options for initial terms of the facility.

Car Loan Eligibility Criteria

For salary individuals

- To apply for a loan you should have a Pakistani nationality means you must have a Pakistani CNIC.

- Your age should be at least twenty-two years or more at and less than sixty to make yourself eligible for the loan. If your age is less than 22 years and more than 60 then sad to say you aren’t eligible for the loan.

- Your minimum monthly income should be at least 20,000 per month to apply for a car loan.

For business individuals

- To apply for a loan you should have a Pakistani nationality means you must have a Pakistani CNIC.

- Your age should be at least twenty-two years or more at and less than seventy to make yourself eligible for the loan. If your age is less than 22 years and more than 70 then sad to say you aren’t eligible for the loan.

- The minimum monthly income should be at least 25000 per month to apply for an HBL car loan.

Documents Needed For HBL Car Loan

For salary individuals

- Original verified copy of CNIC.

- 2 fresh passport size photographs with clear background.

- Salary slip of last 3 months.

For business individuals

- Original verified copy of CNIC.

- 2 fresh passport size photographs with clear background.

- Bank statement of past 6 months and proof of your business.

HBL Car Loan Calculator

You can visit HBL official website for the car loan calculator. Car loan permits you to choose your desire model, year and make you want to drive together with an income source, contribution, and the income car price. The car loan calculator will also calculate the monthly income installment you must have to pay. Through this calculator, you can also apply for a car loan.

How To Use HBL Car Loan Calculator?

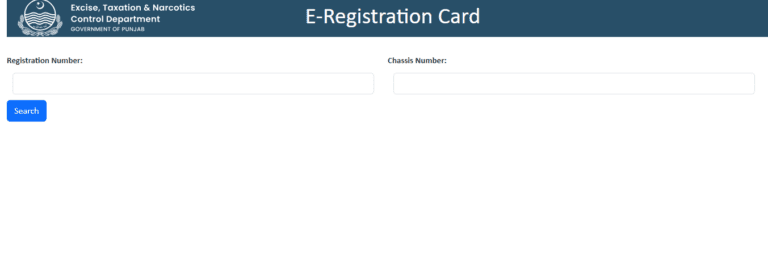

- Go to the HBL official site, visit the car loan calculator page.

- Click on the Calculate plan.

- After clicking on the Calculate plan, select your car type, and city.

- Select suitable tenure, maximum tenure is 7 years.

- Select the down payment you want to pay.

- The minimum down payment is 15% and the maximum down payment is 60%.

- After this click on the calculate button.

- After clicking, the calculator will give you all details about the car’s original price, how much you to do the down payment, and how much installment you have to pay on monthly basis.

Note: with the down payment, you also have to pay the processing fee and insurance fee for the first year. Hbl will also provide you the yearly installment plan.

HBL Services For Car Loan

HBL support services are available for their valued consumers. A 24/7 support center is at service through HBL phone banking which allows consumers to track their loan or repayment account status. If you want to know how to activate your HBL Atm Card Online read our guide.

FAQs

Is there any fee I have to pay for the car loan?

No, HBL doesn’t charge any fee if you apply for a car loan.

How much loan can I get from the HBL car loan?

You can get a loan between 200,000 to 5,000,000.

How many car brands can if I wanted to buy a new car?

You can select from more than 150 car brands and this is more than enough to select from. HBL is covering almost all car brands available in Pakistan.

Can I apply for a car loan if don’t have a Pakistani national identity?

No, you are not eligible to apply for your desired car loan if you don’t have a Pakistani national identity.

Can I apply directly through the car loan calculator?

Yes, if you use the official website of the HBL calculator then you can easily apply directly through the HBL car loan calculator.